Starting a journey with a rented car opens up a world of possibilities for exploration and adventure. However, to ensure a smooth and enjoyable trip, it’s essential to pack the right essentials before hitting the road. In this guide, we’ll outline the must-have items to pack for your luxury rental cars adventure, ranging from practical…

The Impact Of Electrical Engineering In Modern Times

Electrical engineering has revolutionized the way we live, work, communicate, and travel in modern times. From powering our homes and industries to enabling advanced technologies and innovations, electrical engineering in UAE plays a crucial role in shaping the world we inhabit today. Powering infrastructure and industries: One of the most significant impacts of electrical engineering…

Maximizing Value Through Asset Lifecycle Management

Asset lifecycle management is a strategic approach that involves optimizing the entire lifespan of assets, from acquisition to disposal, to maximize value and minimize total cost of ownership. By implementing inclusive practices, investment management companies in Dubai can ensure that assets deliver optimal performance, remain cost-effective, and contribute to long-term business success. Acquisition: The first…

Utilizing Technology For Enhanced Event Management

The event planning landscape has evolved significantly over the years, thanks to advancements in technology. Today, an event planning company in Dubai can utilize cutting-edge technological solutions to streamline operations, increase efficiency, and enhance attendee experiences. From mobile apps and cloud-based software to artificial intelligence and augmented reality, technology offers numerous opportunities to take event…

The Science Of Vaping: How E-cigarettes Work

E-cigarettes, also known as electronic cigarettes or vaping devices, have become increasingly popular as a potential alternative to traditional cigarette smoking in recent years. But how does vape Dubai work, and what is the science behind them? How do e-cigarettes work? E-cigarettes consist of a battery, a heating element, and a cartridge containing the e-liquid, the liquid…

Maximizing Profit through Effective Balance Sheet Management

Effective balance sheet management is crucial for businesses aiming to maximize profit and ensure long-term financial stability. By strategically managing assets, liabilities, and equity, companies can optimize their capital structure, minimize costs, and enhance profitability. In this article, we will explore how businesses can utilize balance sheet management techniques to drive profitability. Optimizing asset allocation:…

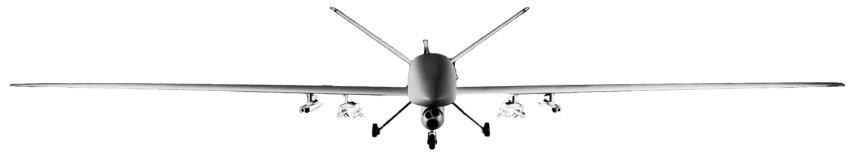

The Benefits Of Working With Drone Companies

Collaborating with drone companies offers a myriad of advantages across various industries, from cost savings and operational efficiency to innovation and enhanced safety measures. Whether for aerial surveys, inspections, or data analysis, partnering with drone companies in Dubai can reveal new possibilities and drive success in your business. Expertise and specialization: Drone companies bring specialized…

A Look Into Diverse Metal Fabrication Techniques

Metal fabrication is an essential process in manufacturing industries, where raw metal materials are shaped into finished products. From simple household items to complex machinery parts, metal fabrication techniques have come a long way in delivering efficient and diverse solutions. Cutting processes: Cutting is the foundational step in metal fabrication, and various techniques are employed…

The Importance Of Oil Gas Security For Different Industries

The oil and gas industry plays a critical role in powering the global economy, providing fuel for transportation, heating, and electricity generation. However, due to its strategic importance and vast infrastructure, this industry faces numerous security challenges. Protecting oil and gas facilities, pipelines, and personnel is of paramount importance to ensure the continuous flow of…

Nurturing Young Minds: Inside The World Of Nursery Education

Nursery education forms the cornerstone of a child’s early learning journey, providing a nurturing and supportive environment for young minds to flourish. These crucial years are marked by rapid development, and nursery schools play a pivotal role in laying the foundation for a child’s overall growth and success. In this article, we will take a…

Mastering The Art Of Digital Marketing

In today’s rapidly evolving digital landscape, mastering the art of digital marketing has become crucial for businesses of all sizes. With the increasing reliance on technology and online platforms, companies must adapt and excel in the digital realm to stay competitive. In this article, we will explore the key elements of digital marketing and provide…

What Does A Real Estate Lawyer Do In Dubai?

Real estate transactions in Dubai can be complex and involve various legal intricacies. A real estate law firm Dubai must have guidance and expertise to navigate the local real estate market effectively. These legal professionals specialize in handling real estate matters and play a crucial role in ensuring that transactions are legally sound and protect…

Heavy-Duty Support: High-Performance Slings For Lifting Equipment

Lifting heavy equipment requires the use of reliable and durable tools to ensure safety and efficiency. High-performance slings are essential components of any lifting operation involving heavy machinery or equipment. These specialized slings are designed to withstand extreme loads and provide robust support. In this article, we will explore the features and benefits of high-performance slings…

Handyman Services: Your One-Stop Solution For Home Repairs

Maintaining a home requires ongoing care and occasional repairs. From fixing a leaky faucet to installing a new light fixture, these tasks can accumulate and become overwhelming. That’s where handyman services come in. Hiring a professional handyman offers a one-stop solution for many home repairs and maintenance needs. In this article, we’ll explore the benefits…

What To Look For When Buying A Shower Set?

When it comes to buying a shower set, there are a few key factors to consider ensuring that you choose the right one for your needs. Here are some things to look for when buying a bathroom shower set: Types of shower heads: There are various types of shower heads available, including fixed shower heads,…

Going Green: A Vegetarian Meal Plan

The world is changing, and so is our approach to food. With the ongoing climate change crisis, people are looking for ways to minimize their carbon footprint and make their diets more sustainable. One way to achieve this is by adopting a vegetarian meal plan. Vegetarianism has numerous health benefits but is also a great way…

Pool Heat Pumps: The Ultimate Solution For Maintaining Ideal Water Temperatures

Swimming pools are a great way to cool off in the hot summer but can quickly become too cold to enjoy without proper heating. This is where swimming pool heat pumps come in. They are the ultimate solution for maintaining ideal water temperatures in your pool. In this article, we’ll explore the benefits of pool heat pumps…

Tips For Finding The Best Business Setup Consultant

Finding the right business setup consultant can make all the difference if you plan to start a business in a new region or country. A good consultant can help you navigate complex regulations, guide the best business structures and licenses, and ensure that your business is set up for success. This article will provide tips…

From Beginner To Pro: How To Improve Your Dance Skills And Technique

Dancing is an art form that requires a combination of skill, technique, and creativity. Whether a beginner or an experienced dancer, there are always ways to improve your skills and technique. In this article, we will provide tips on improving your dance skills and taking your dancing to the next level. Click this link to get…

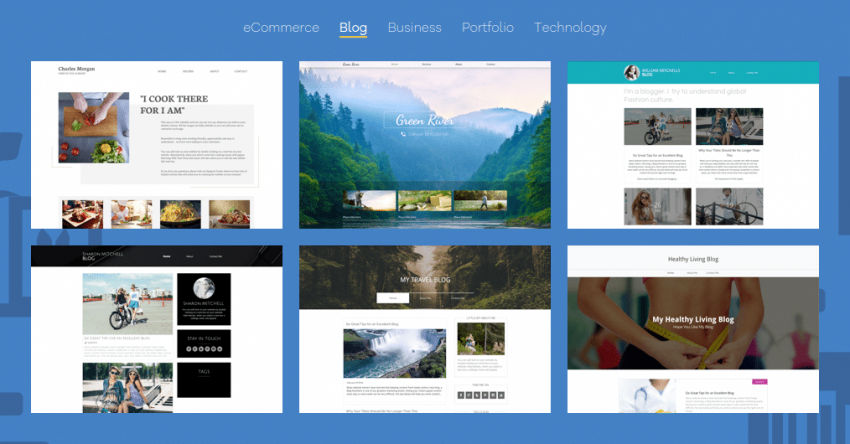

Qualities of the best brand design services

When we talk about the qualities of the best brand design services providers, what are some of these things that we should see in them? For one, you need to see their work portfolio when it comes to custom designs. What should we look for in a design firm? Is there a specific brand that…

Importance of furniture

Furniture is a key element in your entire place in terms of both, functionality as well as appearance. You can not make your space functional without appropriate furniture. Lets suppose if we talk about a hospital then would you think that without proper chairs in the waiting area or without appropriate furniture in a consultant…

Debunking web designing myths

Everyday there are so many questions raised concerning custom PHP website use. However, some people simply assume things themselves and go on believing their own assumptions. This shouldn’t be the case because every single company that is offering help with website development is putting in their efforts to bring the best to you which is…

How to create a website that goes to the higher level

Website creation is not a big deal but taking to the higher level is the most critical and difficult part of any website. There are many websites that are helping people in this regard, they will provide proper assistance and help where needed so that their clients will get their website where they want. If…

Information about wholesale janitorial cleaning equipment

The fact of the matter is that you will not be able to maintain your home, office or commercial space in a neat and clean state without getting the best janitorial and cleaning products and equipment. The one thing that you must bear in mind here is the fact that you will have to invest…

Ways to inspire with your smile

Who never wants to own a Hollywood smile? Obviously no one because a good smile is the sign of your confidence and your success built on it. It is a necessity that when you think about having whiter teeth then you should consult a dentist from any of the Hollywood smile clinic Dubai. These clinics…

How to get an attractive hair style for your child

The fact of the matter is that you cannot expect that your child will have an attractive haircut if you will not get it done by a professional kids hair stylist. Moreover, you will also have to make sure that you choose the right haircut for your child that can effectively enhance his adorable innocent…

Sofa damage and repair FAQs- All about upholstered furniture

Everyone would agree with the fact that furniture is the most important thing in the house. Whether it is about providing comfort and coziness to us or about enhancing the visual appeal of the house; most of the times we rely on furniture for both the things. Certainly, it plays a significant role in creating…

Significance of gymnastics regarding health

The movement of your body matters a lot when it comes to the health of the body. Whether you are doing it by exercising or by gymnastics, you must be sure that you are going to reap all the benefits out of it. If you take care of your health and are conscious about it…

Importance of executive recruitment agencies

There are a number of professional service providers that help individuals as well as businesses in many different ways in the market. Recruitment agencies are surely one of these services that play an important role in the market by offering their services for both job seekers and employers who are looking for manpower. Among these…

Things to know about recruitment agencies

There will be hardly anyone who hasn’t heard about recruitment agencies, but there are many who don’t know what exactly these professional firms do. To make you understand in simple word recruitment agencies are firms that collect database of job seekers that they acquire from various colleges, universities, business organizations, A number of recruitment agencies…